Valuing Vision, Investing In Innovation

At our firm, we prioritize long-term vision and strategic innovation to drive sustainable financial growth for our clients. By investing in cutting-edge solutions and forward-thinking strategies, we help you achieve lasting success in a dynamic financial landscape.

Our Benefit

Our benefit is providing personalized investment strategies that maximize returns while minimizing risk, ensuring your financial growth and security.

Fast Process

Our streamlined investment process ensures fast, efficient service, helping you achieve your financial goals quickly.

Best Quality

We deliver the highest quality financial management, ensuring your investments grow with precision, care, and expertise.

Solution

Our innovative financial solutions are designed to optimize your investments and help you achieve long-term success.

Who We Are

We Aim To Be The Best Invest Manager In The World

We are committed to becoming the world’s leading investment manager by delivering exceptional results and personalized strategies. Our goal is to help you achieve financial success with confidence and trust in our expertise.

Tailored Investment Solutions

Expertise You Can Trust

20+

Years Experience

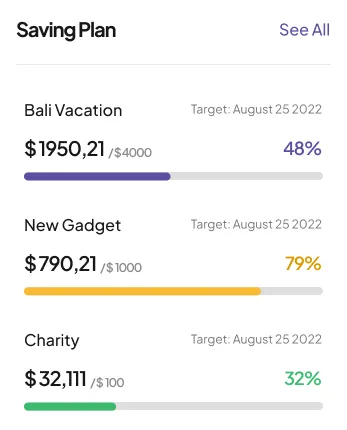

Saving Strategies

Our saving strategies help you grow wealth efficiently and securely.

Competitive Price

We offer competitive pricing to maximize your investment returns and growth.

24/7 Support

Our 24/7 support ensures you're never alone in managing investments.

What Client Say

Here's what our clients have to say about their experience with our investment services:

The personalized attention and expertise I received helped me achieve financial growth I never thought possible.

James Smith

Office Manager

Working with their team has transformed my financial outlook—they truly understand my goals and needs.

Rachel Lee

Office Manager

Their strategic approach to managing my investments has given me peace of mind and consistent returns.

Michael Chen

Office Manager

Frequently Asked Questions

What types of investment services do you offer?

We offer a range of investment services, including portfolio management, retirement planning, wealth preservation, and personalized financial strategies tailored to your unique goals.

How do you determine the best investment strategy for me?

We begin by assessing your financial goals, risk tolerance, and time horizon. Based on this, we create a customized investment plan designed to maximize returns while minimizing risk.

What is the minimum amount required to start investing with your firm?

Our minimum investment requirements vary depending on the services you choose. We offer flexible options to accommodate different levels of investment, from individuals to high-net-worth clients.

How often will I receive updates on my investment performance?

We provide regular reports on your portfolio’s performance, and our advisors are always available to discuss your investments. You can also access real-time updates through our online platform.

Your trusted partner in financial growth and investment success, committed to securing your financial future.

Quick Links

Home

About Us

Services

Useful Links

Testimonials

FAQs

Blog